#Process Automation Market price

Explore tagged Tumblr posts

Text

0 notes

Text

UiPath Inc. Stock Price Forecast: Is It the Right Time to Invest?

Explore UiPath Inc.stock price forecasts, and investment insights. Discover why this leading RPA company could be a valuable #UiPathInc #PATH #investment #stockmarket #stockpriceforecast #stockgrowth #ArtifacialIntelligence #stocinsights #NyseUiPath

UiPath Inc. is a global software company specializing in robotic process automation (RPA) and AI-powered automation. Founded in 2005 by Daniel Dines and Marius Tîrcă in Bucharest, Romania, UiPath’s platform helps businesses automate repetitive tasks, streamline workflows, and boost productivity. The company’s headquarters are in New York City, and it operates in over 31 countries. Continue…

#Artificial intelligence#Automation technology#Financial performance#Innovation#Investment#Investment Insights#Market Analysis#PATH#Robotic process automation (RPA)#Stock Forecast#Stock Insights#Stock Price Forecast#Strategic growth#UiPath Inc

0 notes

Text

Podcasting “Capitalists Hate Capitalism”

I'm touring my new, nationally bestselling novel The Bezzle! Catch me in Torino (Apr 21) Marin County (Apr 27), Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

This week on my podcast, I read "Capitalists Hate Capitalism," my latest column for Locus Magazine:

https://locusmag.com/2024/03/cory-doctorow-capitalists-hate-capitalism/

What do I mean by "capitalists hate capitalism?" It all comes down to the difference between "profits" and "rents." A capitalist takes capital (money, or the things you can buy with it) and combines it with employees' labor, and generates profits (the capitalist's share) and wages (the workers' share).

Rents, meanwhile, come from owning an asset that capitalists need to generate profits. For example, a landlord who rents a storefront to a coffee shop extracts rent from the capitalist who owns the coffee shop. Meanwhile, the capitalist who owns the cafe extracts profits from the baristas' labor.

Capitalists' founding philosophers like Adam Smith hated rents. Worse: rents were the most important source of income at the time of capitalism's founding. Feudal lords owned great swathes of land, and there were armies of serfs who were bound to that land – it was illegal for them to leave it. The serfs owed rent to lords, and so they worked the land in order grow crops and raise livestock that they handed over the to lord as rent for the land they weren't allowed to leave.

Capitalists, meanwhile, wanted to turn that land into grazing territory for sheep as a source of wool for the "dark, Satanic mills" of the industrial revolution. They wanted the serfs to be kicked off their land so that they would become "free labor" that could be hired to work in those factories.

For the founders of capitalism, a "free market" wasn't free from regulation, it was free from rents, and "free labor" came from workers who were free to leave the estates where they were born – but also free to starve unless they took a job with the capitalists.

For capitalism's philosophers, free markets and free labor weren't just a source of profits, they were also a source of virtue. Capitalists – unlike lords – had to worry about competition from one another. They had to make better goods at lower prices, lest their customers take their business elsewhere; and they had to offer higher pay and better conditions, lest their "free labor" take a job elsewhere.

This means that capitalists are haunted by the fear of losing everything, and that fear acts as a goad, driving them to find ways to make everything better for everyone: better, cheaper products that benefit shoppers; and better-paid, safer jobs that benefit workers. For Smith, capitalism is alchemy, a philosopher's stone that transforms the base metal of greed into the gold of public spiritedness.

By contrast, rentiers are insulated from competition. Their workers are bound to the land, and must toil to pay the rent no matter whether they are treated well or abused. The rent rolls in reliably, without the lord having to invest in new, better ways to bring in the harvest. It's a good life (for the lord).

Think of that coffee-shop again: if a better cafe opens across the street, the owner can lose it all, as their customers and workers switch allegiance. But for the landlord, the failure of his capitalist tenant is a feature, not a bug. Once the cafe goes bust, the landlord gets a newly vacant storefront on the same block as the hot new coffee shop that can be rented out at even higher rates to another capitalist who tries his luck.

The industrial revolution wasn't just the triumph of automation over craft processes, nor the triumph of factory owners over weavers. It was also the triumph of profits over rents. The transformation of hereditary estates worked by serfs into part of the supply chain for textile mills was attended by – and contributed to – the political ascendancy of capitalists over rentiers.

Now, obviously, capitalism didn't end rents – just as feudalism didn't require the total absence of profits. Under feudalism, capitalists still extracted profits from capital and labor; and under capitalism, rentiers still extracted rents from assets that capitalists and workers paid them to use.

The difference comes in the way that conflicts between profits and rents were resolved. Feudalism is a system where rents triumph over profits, and capitalism is a system where profits triumph over rents.

It's conflict that tells you what really matters. You love your family, but they drive you crazy. If you side with your family over your friends – even when your friends might be right and your family's probably wrong – then you value your family more than your friends. That doesn't mean you don't value your friends – it means that you value them less than your family.

Conflict is a reliable way to know whether or not you're a leftist. As Steven Brust says, the way to distinguish a leftist is to ask "What's more important, human rights, or property rights?" If you answer "Property rights are human right," you're not a leftist. Leftists don't necessarily oppose all property rights – they just think they're less important than human rights.

Think of conflicts between property rights and human rights: the grocer who deliberately renders leftover food inedible before putting it in the dumpster to ensure that hungry people can't eat it, or the landlord who keeps an apartment empty while a homeless person freezes to death on its doorstep. You don't have to say "No one can own food or a home" to say, "in these cases, property rights are interfering with human rights, so they should be overridden." For leftists property rights can be a means to human rights (like revolutionary land reformers who give peasants title to the lands they work), but where property rights interfere with human rights, they are set aside.

In his 2023 book Technofeudalism, Yanis Varoufakis claims that capitalism has given way to a new feudalism – that capitalism was a transitional phase between feudalism…and feudalism:

https://pluralistic.net/2023/09/28/cloudalists/#cloud-capital

Varoufakis's point isn't that capitalists have gone extinct. Rather, it's that today, conflicts between capital and assets – between rents and profits – reliably end with a victory of rent over profit.

Think of Amazon: the "everything store" appears to be a vast bazaar, a flea-market whose stalls are all operated by independent capitalists who decide what to sell, how to price it, and then compete to tempt shoppers. In reality, though, the whole system is owned by a single feudalist, who extracts 51% from every dollar those merchants take in, and decides who can sell, and what they can sell, and at what price, and whether anyone can even see it:

https://pluralistic.net/2024/03/01/managerial-discretion/#junk-fees

Or consider the patent trolls of the Eastern District of Texas. These "companies" are invisible and produce nothing. They consist solely of a serviced mailbox in a dusty, uninhabited office-building, and an overbroad patent (say, a patent on "tapping on a screen with your finger") issued by the US Patent and Trademark Office. These companies extract hundreds of millions of dollars from Apple, Google, Samsung for violating these patents. In other words, the government steps in and takes vast profits generated through productive activity by companies that make phones, and turns that money over as rent paid to unproductive companies whose sole "product" is lawsuits. It's the triumph of rent over profit.

Capitalists hate capitalism. All capitalists would rather extract rents than profits, because rents are insulated from competition. The merchants who sell on Jeff Bezos's Amazon (or open a cafe in a landlord's storefront, or license a foolish smartphone patent) bear all the risk. The landlords – of Amazon, the storefront, or the patent – get paid whether or not that risk pays off.

This is why Google, Apple and Samsung also have vast digital estates that they rent out to capitalists – everything from app stores to patent portfolios. They would much rather be in the business of renting things out to capitalists than competing with capitalists.

Hence that famous Adam Smith quote: "People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices." This is literally what Google and Meta do:

https://en.wikipedia.org/wiki/Jedi_Blue

And it's what Apple and Google do:

https://www.theverge.com/2023/10/27/23934961/google-antitrust-trial-defaults-search-deal-26-3-billion

Why compete with one another when you can collude, like feudal lords with adjacent estates who trust one another to return any serf they catch trying to sneak away in the dead of night?

Because of course, it's not just "free markets" that have been captured by rents ("Competition is for losers" -P. Thiel) – it's also "free labor." For years, the largest tech and entertainment companies in America illegally colluded on a "no poach" agreement not to hire one-anothers' employees:

https://techcrunch.com/2015/09/03/apple-google-other-silicon-valley-tech-giants-ordered-to-pay-415m-in-no-poaching-suit/

These companies were bitter competitors – as were these sectors. Even as Big Content was lobbying for farcical copyright law expansions and vowing to capture Big Tech, all these companies on both sides were able to set aside their differences and collude to bind their free workers to their estates and end the "wasteful competition" to secure their labor.

Of course, this is even more pronounced at the bottom of the labor market, where noncompete "agreements" are the norm. The median American worker bound by a noncompete is a fast-food worker whose employer can wield the power of the state to prevent that worker from leaving behind the Wendy's cash-register to make $0.25/hour more at the McDonald's fry trap across the street:

https://pluralistic.net/2022/02/02/its-the-economy-stupid/#neofeudal

Employers defend this as necessary to secure their investment in training their workers and to ensure the integrity of their trade secrets. But why should their investments be protected? Capitalism is about risk, and the fear that accompanies risk – fear that drives capitalists to innovate, which creates the public benefit that is the moral justification for capitalism.

Capitalists hate capitalism. They don't want free labor – they want labor bound to the land. Capitalists benefit from free labor: if you have a better company, you can tempt away the best workers and cause your inferior rival to fail. But feudalists benefit from un-free labor, from tricks like "bondage fees" that force workers to pay in order to quit their jobs:

https://pluralistic.net/2023/04/21/bondage-fees/#doorman-building

Companies like Petsmart use "training repayment agreement provisions" (TRAPs) to keep low-waged workers from leaving for better employers. Petsmart says it costs $5,500 to train a pet-groomer, and if that worker is fired, laid off, or quits less than two years, they have to pay that amount to Petsmart:

https://pluralistic.net/2022/08/04/its-a-trap/#a-little-on-the-nose

Now, Petsmart is full of shit here. The "four-week training course" Petsmart claims is worth $5,500 actually only lasts for three weeks. What's more, the "training" consists of sweeping the floor and doing other low-level chores for three weeks, without pay.

But even if Petsmart were to give $5,500 worth of training to every pet-groomer, this would still be bullshit. Why should the worker bear the risk of Petsmart making a bad investment in their training? Under capitalism, risks justify rewards. Petsmart's argument for charging $50 to groom your dog and paying the groomer $15 for the job is that they took $35 worth of risk. But some of that risk is being borne by the worker – they're the ones footing the bill for the training.

For Petsmart – as for all feudalists – a worker (with all the attendant risks) can be turned into an asset, something that isn't subject to competition. Petsmart doesn't have to retain workers through superior pay and conditions – they can use the state's contract-enforcement mechanism instead.

Capitalists hate capitalism, but they love feudalism. Sure, they dress this up by claiming that governmental de-risking spurs investment: "Who would pay to train a pet-groomer if that worker could walk out the next day and shave dogs for some competing shop?"

But this is obvious nonsense. Think of Silicon Valley: high tech is the most "IP-intensive" of all industries, the sector that has had to compete most fiercely for skilled labor. And yet, Silicon Valley is in California, where noncompetes are illegal. Every single successful Silicon Valley company has thrived in an environment in which their skilled workers can walk out the door at any time and take a job with a rival company.

There's no indication that the risk of free labor prevents investment. Think of AI, the biggest investment bubble in human history. All the major AI companies are in jurisdictions where noncompetes are illegal. Anthropic – OpenAI's most serious competitor – was founded by a sister/brother team who quit senior roles at OpenAI and founded a direct competitor. No one can claim with a straight face that OpenAI is now unable to raise capital on favorable terms.

What's more, when OpenAI founder Sam Altman was forced out by his board, Microsoft offered to hire him – and 700 other OpenAI personnel – to found an OpenAI competitor. When Altman returned to the company, Microsoft invested more money in OpenAI, despite their intimate understanding that anyone could hire away the company's founder and all of its top technical staff at any time.

The idea that the departure of the Burger King trade secrets locked up in its workers' heads constitute more of a risk to the ability to operate a hamburger restaurant than the departure of the entire technical staff of OpenAI is obvious nonsense. Noncompetes aren't a way to make it possible to run a business – they're a way to make it easy to run a business, by eliminating competition and pushing the risk onto employees.

Because capitalists hate capitalism. And who can blame them? Who wouldn't prefer a life with less risk to one where you have to constantly look over your shoulder for competitors who've found a way to make a superior offer to your customers and workers?

This is why businesses are so excited about securing "IP" – that is, a government-backed right to control your workers, customers, competitors or critics:

https://locusmag.com/2020/09/cory-doctorow-ip/

The argument for every IP right expansion is the same: "Who would invest in creating something new without the assurance that someone else wouldn’t copy and improve on it and put them out of business?"

That was the argument raised five years ago, during the (mercifully brief) mania for genre writers seeking trademarks on common tropes. There was the romance writer who got a trademark on the word "cocky" in book titles:

https://www.theverge.com/2018/7/16/17566276/cockygate-amazon-kindle-unlimited-algorithm-self-published-romance-novel-cabal

And the fantasy writer who wanted a trademark on "dragon slayer" in fantasy novel titles:

https://memex.craphound.com/2018/06/14/son-of-cocky-a-writer-is-trying-to-trademark-dragon-slayer-for-fantasy-novels/

Who subsequently sought a trademark on any book cover featuring a person holding a weapon:

https://memex.craphound.com/2018/07/19/trademark-troll-who-claims-to-own-dragon-slayer-now-wants-exclusive-rights-to-book-covers-where-someone-is-holding-a-weapon/

For these would-be rentiers, the logic was the same: "Why would I write a book about a dragon-slayer if I could lose readers to someone else who writes a book about dragon-slayers?"

In these cases, the USPTO denied or rescinded its trademarks. Profits triumphed over rents. But increasingly, rents are triumphing over profits, and rent-extraction is celebrated as "smart business," while profits are for suckers, only slightly preferable to "wages" (the worst way to get paid under both capitalism and feudalism).

That's what's behind all the talk about "passive income" – that's just a euphemism for "rent." It's what Douglas Rushkoff is referring to in Survival of the Richest when he talks about the wealthy wanting to "go meta":

https://pluralistic.net/2022/09/13/collapse-porn/#collapse-porn

Don't drive a cab – go meta and buy a medallion. Don't buy a medallion, go meta and found Uber. Don't found Uber, go meta and invest in Uber. Don't invest in Uber, go meta and buy options on Uber stock. Don't buy Uber stock options, go meta and buy derivatives of options on Uber stock.

"Going meta" means distancing yourself from capitalism – from income derived from profits, from competition, from risk – and cozying up to feudalism.

Capitalists have always hated capitalism. The owners of the dark Satanic mills wanted peasants turned off the land and converted into "free labor" – but they also kidnapped Napoleonic war-orphans and indentured them to ten-year terms of service, which was all you could get out of a child's body before it was ruined for further work:

https://pluralistic.net/2023/09/26/enochs-hammer/#thats-fronkonsteen

When Varoufakis says we've entered a new feudal age, he doesn't mean that we've abolished capitalism. He means that – for the first time in centuries – when rents go to war against profits – the rents almost always emerge victorious.

Here's the podcast episode:

https://craphound.com/news/2024/04/14/capitalists-hate-capitalism/

Here's a direct link to the MP3 (hosting courtesy of the Internet Archive; they'll host your stuff for free, forever):

https://archive.org/download/Cory_Doctorow_Podcast_465/Cory_Doctorow_Podcast_465_-_Capitalists_Hate_Capitalism.mp3

And here's the RSS feed for my podcast:

http://feeds.feedburner.com/doctorow_podcast

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/18/in-extremis-veritas/#the-winnah

1K notes

·

View notes

Text

OPTİVİSER - GOLD

Welcome to Optiviser.com, your ultimate guide to navigating the complex world of electronics in 2024. As technology continues to evolve at a rapid pace, finding the right devices that suit your needs can be overwhelming. In this blog post, we’ll harness the power of AI to help you make informed choices with our comprehensive electronics comparison. We’ll take a closer look at the top smart home devices that are revolutionizing how we live and work, providing convenience and efficiency like never before. Additionally, we’ll offer expert laptop recommendations tailored to various lifestyles and budgets, ensuring you find the perfect match for your daily tasks.

AI-powered Electronics Comparison

In today's fast-paced technological landscape, making informed choices about electronics can be overwhelming. An AI-powered Electronics Comparison tool can help streamline this process by providing insights that cater to specific user needs. These advanced tools utilize algorithms that analyze product features, specifications, and user reviews, resulting in a tailored recommendation for buyers.

As we delve into the world of consumer technology, it's important to highlight the Top Smart Home Devices 2024. From smart thermostats to security cameras, these devices are becoming essential for modern households. They not only enhance convenience but also significantly improve energy efficiency and home safety.

For those looking for a new computer to enhance productivity or gaming experiences, consider checking out the latest Laptop Recommendations. Many platforms, including Optiviser.com, provide comprehensive comparisons and insights that can help consumers choose the best laptop suited to their needs, whether it’s for work, study, or leisure.

Top Smart Home Devices 2024

As we move into 2024, the landscape of home automation is evolving rapidly, showcasing an array of innovative gadgets designed to enhance comfort and convenience. In this era of AI-powered Electronics Comparison, selecting the right devices can be overwhelming, but we've highlighted some of the best Top Smart Home Devices 2024 that stand out for their functionality and user experience.

One of the most impressive innovations for this year is the latest AI-powered home assistant. These devices not only respond to voice commands but also learn your preferences over time, allowing them to offer personalized suggestions and perform tasks proactively. Imagine a device that can monitor your schedule and automatically adjust your home's temperature and lighting accordingly!

Moreover, security remains a top priority in smart homes. The Top Smart Home Devices 2024 include state-of-the-art security cameras and smart locks that provide robust protection while ensuring ease of access. With features like remote monitoring through your smartphone or integration with smart doorbells, keeping your home safe has never been easier. For more details on the comparisons and recommendations of these devices, you can check out Optiviser.com.

Laptop Recommendation

In today's fast-paced world, choosing the right laptop can be a daunting task. With numerous options available in the market, it's essential to consider various factors such as performance, portability, and price. At Optiviser.com, we provide an insightful guide to help you navigate through the vast array of choices. To streamline your decision-making process, we have developed an AI-powered Electronics Comparison tool that allows you to compare specifications and features of different laptops side by side.

This year, we have seen a surge in innovative laptops that cater to diverse needs. Whether for gaming, business, or everyday use, our top recommendations include models that excel in battery life, processing power, and display quality. For instance, consider the latest models from top brands, which have integrated the best features of Top Smart Home Devices 2024 trends, ensuring seamless connectivity and advanced functionalities.

Additionally, if you're looking for a laptop that can handle multitasking effortlessly, we suggest models equipped with the latest processors and ample RAM. Our detailed Laptop Recommendation section on Optiviser.com includes expert reviews and user feedback to help you choose a laptop that not only fits your budget but also meets your specific requirements.

674 notes

·

View notes

Text

I blogged before about this company, Orange, that is an AI-powered manga translation company. Essentially, their pitch is that most manga is still (officially) untranslated, a ton of manga gets made after all but few become mainstream enough to get ported overseas. They posit the barrier to that is the cost of translation; if they could automate that process, then they can make viable for release what previously was not. That concept rests on two questions - does the tech pan out, and does the economics add up?

Recently they went live, under the name Emaqi, so we can better explore those questions. What I notice on first glance is the pitch seems to have shifted a little bit in post:

You are not the translators of Vinland Saga, Witch Hat Atelier, or Magic Knight Rayearth, very obviously so. They have Sailor Moon in here lol. These are just the official translations being cross-listed into their "manga platform", where you buy it there and it lives, DRM-locked, in their app. Which is fair enough as a model, that is just Kindle, it works. Though Kindle and a dozen others already exist, so their value-add has to be the AI translation stuff right? That is why I would choose this over another app.

Which they do have, though it is kind of buried:

"Only on emaqi" - there is no mention of the translation approach, poor guys! Can't fault the branding decision I guess given the state of the discourse. When it comes to the products themselves, I went through ~6 or so of the sample chapters of different manga, did a few spot checks with the original Japanese, and read the reviews of some others who looked into it. They seem fine! I am cautiously impressed, I think there proofers did a good job smoothing out some edges, it has a "manga tone", and while small issues like the hyphenation the reviewer above mentioned do exist and are legit noticeable, they aren't common and not a huge deal. It has flow issues? Some dialogue should link together in how it is written, but doesn't. But it isn't crazy off or anything. You will not be wowed by these, but certainly if you are someone who reads bootleg scanlations you are gonna have no problems. A lot of manga uses pretty simple vocab and isn't breaking new ground on plot, I can see how a purpose-built tool could handle it well enough.

The economics though...here is where I don't think this case was ever going to pencil out and isn't now. Because I am pretty sure no one here has heard of any of the manga listed above as exclusives. (I saw 90's manga Geobreeders in there, but that was already partially translated in the 2000's, not sure if they did a new one? Setting it aside) Which, of course you haven't, if you had it probably would have been translated! Books are a 90:10 market, most books never get read and some books get read a ton. Anything big enough can justify a professional translation, and the other can't really sell to begin with.

On top of that, their model is mass translation; which means these obscure manga are presented to you with no context, no hype, no build-up. Wtf is The Blood Blooms In the Barrens?? See, if you were like a boutique publisher, selecting "the best of the best" in untranslated manga, you would promote your specific product. Interviews, social media, the value of the brand-itself as a quality seal. Publishing less is more, actually, your value as a publisher is as a quality selector. Or you could be say the porn market, where you max quantity so people can search "foot fetish breeding kink oshi no ko" and get results; they know what they want. But they aren't doing either! And to be blunt a lot of these are not gonna sell on their art alone:

I'm not mocking The Delayed Highschool Life of a Laborer here, that is better than I could do; but if you want to me spend money on a whim the bar is high and these don't reach it. Which of course they don't, they would be professionally translated if they did.

And finally, the price - $5 dollars, for volume 1's, like a 100-200 pages. The cross-listed manga typically sells for ~$10? That isn't much cheaper! If "translation" was this big cost barrier, and all you got is cutting the price of ebooks in half, I don't know if the analysis was so solid. This is a new product, I doubt they are overcharging to make a quick buck right now - this is the "sell at cost to scale" era.

In all of their lead up press they would say things like this:

Orange's process uses AI to read the manga through image analysis and character recognition, then to translate the words into English, Chinese and other languages. The technology is specialized for manga, meaning it is able to handle wordplay and other difficult-to-translate phrases. A human translator then makes corrections and adjustments. The process can deliver a manga translation in as little as two days. Orange will work with multiple Japanese publishers. The company looks initially to complete 500 translations monthly.

But this is missing a lot of context. For one, these manga are simple high school or battle manga that are ~200 pages long, many of those pages have only a few lines of dialogue, etc. Imagine you are a professional translator, and you are given that manga to translate, all the set-up done for you, all you gotta do is write. How long do you think that would take? Not that long! It could probably take like a week if it's actually all you did (calc'd from a 10k word count manga volume, 2k is a typical "good translator" per day count - many manga are shorter than that). And note how they said "as little as two days" - not median two days! Just, you know, aspirationally.

Translation is just not a big bottleneck. You gotta do layouts, lettering, proofs, etc, these can all take just as much time - and are being done by people, they still need wage workers doing all this. But that is small fry in comparison to publishing contracts, author approvals, distribution, all of that. And most importantly, product acquisition - you have to get authors to sign with you! That can be months of work. I am sure they are trying to get bulk agreements with publishers and such, but authors will push back on that, this is not an easy endeavor.

Which is why, in above, they say they hope to have "500 translations monthly". And after a year+ of work, on launch, they have...

...18. As best I can tell at least, their site deliberately obfuscates what they actually translated versus are just hosting for resale after all.

So yeah, as mentioned I don't think the economics pencil out. These aren't worth $5 dollars, they can't actually generate volume that makes "massive economies of scale" actually valuable, and their approach is currently antithetical to the idea of generating traction for any of their individual works. Niche publishing just doesn't work this way.

But it is early days, and hey I respect the experiment! I do think the tech is pretty good, and it is nice to see a company showcase it. It isn't quite good enough yet for prime time, but it could get there. I do want more manga to get exposure and audience; I will give a fair shake to any who try.

33 notes

·

View notes

Text

On a 5K screen in Kirkland, Washington, four terminals blur with activity as artificial intelligence generates thousands of lines of code. Steve Yegge, a veteran software engineer who previously worked at Google and AWS, sits back to watch.

“This one is running some tests, that one is coming up with a plan. I am now coding on four different projects at once, although really I’m just burning tokens,” Yegge says, referring to the cost of generating chunks of text with a large language model (LLM).

Learning to code has long been seen as the ticket to a lucrative, secure career in tech. Now, the release of advanced coding models from firms like OpenAI, Anthropic, and Google threatens to upend that notion entirely. X and Bluesky are brimming with talk of companies downsizing their developer teams—or even eliminating them altogether.

When ChatGPT debuted in late 2022, AI models were capable of autocompleting small portions of code—a helpful, if modest step forward that served to speed up software development. As models advanced and gained “agentic” skills that allow them to use software programs, manipulate files, and access online services, engineers and non-engineers alike started using the tools to build entire apps and websites. Andrej Karpathy, a prominent AI researcher, coined the term “vibe coding” in February, to describe the process of developing software by prompting an AI model with text.

The rapid progress has led to speculation—and even panic—among developers, who fear that most development work could soon be automated away, in what would amount to a job apocalypse for engineers.

“We are not far from a world—I think we’ll be there in three to six months—where AI is writing 90 percent of the code,” Dario Amodei, CEO of Anthropic, said at a Council on Foreign Relations event in March. “And then in 12 months, we may be in a world where AI is writing essentially all of the code,” he added.

But many experts warn that even the best models have a way to go before they can reliably automate a lot of coding work. While future advancements might unleash AI that can code just as well as a human, until then relying too much on AI could result in a glut of buggy and hackable code, as well as a shortage of developers with the knowledge and skills needed to write good software.

David Autor, an economist at MIT who studies how AI affects employment, says it’s possible that software development work will be automated—similar to how transcription and translation jobs are quickly being replaced by AI. He notes, however, that advanced software engineering is much more complex and will be harder to automate than routine coding.

Autor adds that the picture may be complicated by the “elasticity” of demand for software engineering—the extent to which the market might accommodate additional engineering jobs.

“If demand for software were like demand for colonoscopies, no improvement in speed or reduction in costs would create a mad rush for the proctologist's office,” Autor says. “But if demand for software is like demand for taxi services, then we may see an Uber effect on coding: more people writing more code at lower prices, and lower wages.”

Yegge’s experience shows that perspectives are evolving. A prolific blogger as well as coder, Yegge was previously doubtful that AI would help produce much code. Today, he has been vibe-pilled, writing a book called Vibe Coding with another experienced developer, Gene Kim, that lays out the potential and the pitfalls of the approach. Yegge became convinced that AI would revolutionize software development last December, and he has led a push to develop AI coding tools at his company, Sourcegraph.

“This is how all programming will be conducted by the end of this year,” Yegge predicts. “And if you're not doing it, you're just walking in a race.”

The Vibe-Coding Divide

Today, coding message boards are full of examples of mobile apps, commercial websites, and even multiplayer games all apparently vibe-coded into being. Experienced coders, like Yegge, can give AI tools instructions and then watch AI bring complex ideas to life.

Several AI-coding startups, including Cursor and Windsurf have ridden a wave of interest in the approach. (OpenAI is widely rumored to be in talks to acquire Windsurf).

At the same time, the obvious limitations of generative AI, including the way models confabulate and become confused, has led many seasoned programmers to see AI-assisted coding—and especially gung-ho, no-hands vibe coding—as a potentially dangerous new fad.

Martin Casado, a computer scientist and general partner at Andreessen Horowitz who sits on the board of Cursor, says the idea that AI will replace human coders is overstated. “AI is great at doing dazzling things, but not good at doing specific things,” he said.

Still, Casado has been stunned by the pace of recent progress. “I had no idea it would get this good this quick,” he says. “This is the most dramatic shift in the art of computer science since assembly was supplanted by higher-level languages.”

Ken Thompson, vice president of engineering at Anaconda, a company that provides open source code for software development, says AI adoption tends to follow a generational divide, with younger developers diving in and older ones showing more caution. For all the hype, he says many developers still do not trust AI tools because their output is unpredictable, and will vary from one day to the next, even when given the same prompt. “The nondeterministic nature of AI is too risky, too dangerous,” he explains.

Both Casado and Thompson see the vibe-coding shift as less about replacement than abstraction, mimicking the way that new languages like Python build on top of lower-level languages like C, making it easier and faster to write code. New languages have typically broadened the appeal of programming and increased the number of practitioners. AI could similarly increase the number of people capable of producing working code.

Bad Vibes

Paradoxically, the vibe-coding boom suggests that a solid grasp of coding remains as important as ever. Those dabbling in the field often report running into problems, including introducing unforeseen security issues, creating features that only simulate real functionality, accidentally running up high bills using AI tools, and ending up with broken code and no idea how to fix it.

“AI [tools] will do everything for you—including fuck up,” Yegge says. “You need to watch them carefully, like toddlers.”

The fact that AI can produce results that range from remarkably impressive to shockingly problematic may explain why developers seem so divided about the technology. WIRED surveyed programmers in March to ask how they felt about AI coding, and found that the proportion who were enthusiastic about AI tools (36 percent) was mirrored by the portion who felt skeptical (38 percent).

“Undoubtedly AI will change the way code is produced,” says Daniel Jackson, a computer scientist at MIT who is currently exploring how to integrate AI into large-scale software development. “But it wouldn't surprise me if we were in for disappointment—that the hype will pass.”

Jackson cautions that AI models are fundamentally different from the compilers that turn code written in a high-level language into a lower-level language that is more efficient for machines to use, because they don’t always follow instructions. Sometimes an AI model may take an instruction and execute better than the developer—other times it might do the task much worse.

Jackson adds that vibe coding falls down when anyone is building serious software. “There are almost no applications in which ‘mostly works’ is good enough,” he says. “As soon as you care about a piece of software, you care that it works right.”

Many software projects are complex, and changes to one section of code can cause problems elsewhere in the system. Experienced programmers are good at understanding the bigger picture, Jackson says, but “large language models can't reason their way around those kinds of dependencies.”

Jackson believes that software development might evolve with more modular codebases and fewer dependencies to accommodate AI blind spots. He expects that AI may replace some developers but will also force many more to rethink their approach and focus more on project design.

Too much reliance on AI may be “a bit of an impending disaster,” Jackson adds, because “not only will we have masses of broken code, full of security vulnerabilities, but we'll have a new generation of programmers incapable of dealing with those vulnerabilities.”

Learn to Code

Even firms that have already integrated coding tools into their software development process say the technology remains far too unreliable for wider use.

Christine Yen, CEO at Honeycomb, a company that provides technology for monitoring the performance of large software systems, says that projects that are simple or formulaic, like building component libraries, are more amenable to using AI. Even so, she says the developers at her company who use AI in their work have only increased their productivity by about 50 percent.

Yen adds that for anything requiring good judgement, where performance is important, or where the resulting code touches sensitive systems or data, “AI just frankly isn't good enough yet to be additive.”

“The hard part about building software systems isn't just writing a lot of code,” she says. “Engineers are still going to be necessary, at least today, for owning that curation, judgment, guidance and direction.”

Others suggest that a shift in the workforce is coming. “We are not seeing less demand for developers,” says Liad Elidan, CEO of Milestone, a company that helps firms measure the impact of generative AI projects. “We are seeing less demand for average or low-performing developers.”

“If I'm building a product, I could have needed 50 engineers and now maybe I only need 20 or 30,” says Naveen Rao, VP of AI at Databricks, a company that helps large businesses build their own AI systems. “That is absolutely real.”

Rao says, however, that learning to code should remain a valuable skill for some time. “It’s like saying ‘Don't teach your kid to learn math,’” he says. Understanding how to get the most out of computers is likely to remain extremely valuable, he adds.

Yegge and Kim, the veteran coders, believe that most developers can adapt to the coming wave. In their book on vibe coding, the pair recommend new strategies for software development including modular code bases, constant testing, and plenty of experimentation. Yegge says that using AI to write software is evolving into its own—slightly risky—art form. “It’s about how to do this without destroying your hard disk and draining your bank account,” he says.

8 notes

·

View notes

Text

The more I read economics literature about automation trends and globalization trends (the actual economics term, not the rabid racist term) and their economic impacts on developed economies, the more I realize that the fundamental picture we have been sold these things is a lie.

The general picture of automation revolutions is that they present some way of doing work more efficiently and/or to create a better product, and so market forces simply demand it. And we have to figure out how to deal with all of the lost jobs which are resulting from this. Because even in a socialist utopia, surely it would be absurd to continue forcing people to use old and outdated technology to do work less efficiently just so they could have work to do, right? Maybe the socialist utopia will take care of people displaced by this work better, but the displacement will still happen.

Except then I start reading about the actual history in the actual economics of automation revolutions (I recommend Blood In The Machine for a history of the Luddites and the automated textile revolution in Britain). And that's not what happens even a single time. These automated revolutions increase the cost per unit to create a good! They make the quality worse! And the existing workers get displaced, and replaced with oppressed or even outright enslaved labors who make nothing in worse conditions! They didn't even actually reduce the amount of labor involved significantly, they just started working orphan slaves 80-90 hours a week rather than artisan workers doing 30-35, to "reduce" the labor involved by reducing the number of laborers. It seems like no one benefits from this. So why is it happening!?

Well the answer is simple. The machine looms were less efficient, created lower quality products, and were worse for every single person in every sector of the economy ... except insofar as that they enabled a more unequal economy. The textile industry itself made less profit. The world itself had worse and less textiles. But the machine loom owners specifically made more money, because machine rooms enabled more control over workers in ways which could be used to relegate them to an even smaller share of the smaller profits. And they didn't outcompete others by being better, they did it through regulatory capture, illegal business practices, outright fraud, and by having a pre-existing place of power in their society.

The same applies to the classic story of Ford and his great automobile factory model. Sure it produced a lot of cars at low prices, but what the history doesn't tell you is that a bunch of other automobile companies which weren't using the factory model were putting out their own cars similar cost. Sure they weren't scaling up as fast, but everyone involved was making good money and the market kept on producing more companies to fill the gap. Ford made the decision to sell to a new lower cost car market sure, but he did not make a better profit margin per dollar of car purchases than his competitors did. He made significantly worse actually because he had such hideous turnover at his factories, and his cars were of lower quality than non-factory line cars aimed at the same market could be.

So why the hell did the entire automobile industry follow in his wake? Well, because he personally was making an insane amount of money. The factory line model let him simplify the production chain in a way which cut out a lot of people who previously been making good salaries, and it let him replace well paid laborers with dirt cheap labor. (Despite the hubbub about how good Ford's factory jobs paid, they only paid well relative to other no skill no training work available. They paid much worse than the skilled laborers he fired had made.)

And the people who controlled how the car manufacturing process worked were the people who would stand to make money by switching over.

The same is true for globalization. When a berry monopoly which controls 60% of all berry sales in the US does so by importing berries from South America, from varieties optimized for durability rather than flavor, that isn't cheaper than growing them at home. Not even with the higher cost of labor in the US. Not even if you actually paid farm hands a good wage rather than by abusing undocumented workers who can't fight back as effectively. The transport costs are too high.

All across the US food sector we have examples of food monopolies exporting produce production overseas in ways that make the final product more expensive for the customer, and lower quality at the same time. Why!?

Well because it allows them to access even more vulnerable labor markets. So even though the whole pie shrinks, the company owners get a bigger enough cut of the pie to make up for it.

The lie of automation and globalization of work and the damage it does to developed economies is just that, a lie. It is not economically predestined for this stuff to happen. Alternatives are not predestined to be competed out of the market. Unless, of course, ownership of profits is concentrated in only a few hands. Unless what's being competed for isn't net profit or net service provided or net quality of goods, but how much profit you can localize in capital owners.

If that's the actual competition, and of course it is because the people making decisions for companies also own those companies, only then does job automation and the presence of exploitable overseas labor devastate economies.

If laborers actually owned their places of business piecemeal, the motivation for these kinds of economic shocks would largely dry up. Like, sure, labor saving devices get invented sometimes and you need less people to do the same work. And sure, sometimes work can be done overseas for cheaper because standards of living at lower or because there's some comparative economic advantage. But that is not actually what is happening most of the time this stuff occurs.

If there's one thing I've learned studying this stuff, it's that genuine examples of net gain automation are less common than we think, and tend to be implemented on fairly slower timelines. Same for globalization of work. What is very common is ways in which already unequal systems of ownership and decision making and profit can be made more unequal. And the only fix I can imagine is fundamentally changing and democratizing how businesses operate, and how we handle concepts of ownership.

#also I know this can read as dismissive of the impacts#of this stuff on the labor forces most exploited by it#especially in South America#it's just that I'm trying to come at this from the perspective of#the justification of the existing system uses#which do not care about that kind of suffering#and trying to point out how they don't even do the things they claim to do

37 notes

·

View notes

Text

How Do Trading Applications Help You Stay Ahead in the Stock Market?

Understanding Stock Trading Apps

Stock trading apps are mobile tools that let users manage investments and execute trades in real time. Designed for both beginners and seasoned traders, they simplify market participation through intuitive interfaces and instant access to data.

The best trading apps integrate features like live market updates, customizable watchlists, and analytical tools to support informed decision-making. Users can monitor portfolio performance, receive price alerts, and track trends, all while managing investments on the go. This flexibility has made such apps indispensable for modern investors seeking efficiency.

The Evolution of Stock Trading Through Mobile Apps

Mobile applications have transformed how individuals engage with financial markets, making stock trading more accessible than ever. While these the best Stock market mobile trading app offer unparalleled convenience, they also come with challenges, including technical glitches and cybersecurity risks.

Mechanics Behind Stock Trading Apps

These apps act as gateways to brokerage accounts, enabling users to buy or sell assets with a few taps. After setting up an account—which involves identity verification and funding—traders can execute orders, analyze charts, and access news seamlessly.

These the best trading platform provide detailed reviews and comparisons, helping users evaluate app reliability, data accuracy, and service quality. By aggregating expert insights, these resources simplify the process of identifying apps that best meet individual needs.

Advantages of Stock Trading Apps

Instant Market Access: Real-time data and lightning-fast trade execution allow users to capitalize on market shifts immediately.

Portability: Manage investments anytime, anywhere, eliminating the need for desktop-bound trading.

Educational Resources: Many apps offer tutorials, webinars, and research tools to help users refine their strategies.

Potential Drawbacks

Technical Vulnerabilities: Server outages or lagging data can delay trades, potentially leading to missed opportunities.

Security Risks: Despite encryption protocols, the risk of cyberattacks remains a concern, necessitating strong passwords and vigilance.

Limited Guidance: Automated platforms lack personalized advice, which may leave novice investors unsure about complex decisions.

Choosing the Right App

When selecting a stock trading app, prioritize factors like security measures, fee structures, and user experience. Cross-referencing reviews on sites can highlight strengths and weaknesses. Additionally, assess whether the app’s features—such as advanced charting or educational content—align with your skill level and goals. Many of these apps also simplify the demat account opening process, allowing users to quickly start trading with seamless onboarding and verification.

Final Thoughts

Stock trading apps democratize market participation but require careful consideration of their pros and cons. By balancing convenience with due diligence, investors can leverage these tools to build and manage portfolios effectively. Always supplement app-based trading with independent research or professional advice to navigate the markets confidently.

For more information, visit https://www.indiratrade.com/

#stock trading apps#best trading apps#online trading#stock market apps#trading platforms#investing apps#demat account opening#mobile trading#best trading platform#stock market investing#portfolio management apps

5 notes

·

View notes

Text

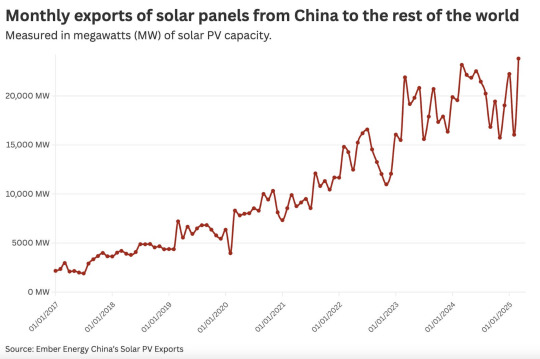

Excerpt from Sustainability by Numbers:

When it comes to clean energy technologies, China is crushing it.

It dominates the supply chain of the main energy minerals. It’s not only rolling out solar power rapidly at home, it’s also exporting huge amounts of solar panels elsewhere. Take a look at the chart [above], which shows solar PV exports from China to the rest of the world. Increasingly, these panels are going to low-to-middle income countries who are hungry for energy, and will go after whatever’s cheap: that’s Chinese solar.

It produces three-quarters of the world’s batteries. Its largest EV carmaker, BYD, is producing high-quality electric cars for as little as $10,000, and is growing rapidly in many markets across the world. BYD is now targetting the domestic battery market. CATL, the world’s largest battery manufacturer, is pushing the limits of battery technologies, with claims that it can add 300 miles of charge in just 5 minutes (I have some doubts about battery degradation, but I’d obviously love this to be true). The list goes on.

European and American manufacturers are being left in the dirt. One response has been protectionist policies: slapping on tariffs and implementing import quotas. A few newsletters ago, I argued that these were not good interventions if the goal was to increase the number of energy jobs in European and American markets. That’s because most clean energy jobs are in deployment and maintenance rather than manufacturing, and since higher costs slow down the rollout of renewables, increasing prices reduces the total number of people working in clean energy (even if the number working in manufacturing increases).

It produces three-quarters of the world’s batteries. Its largest EV carmaker, BYD, is producing high-quality electric cars for as little as $10,000, and is growing rapidly in many markets across the world. BYD is now targetting the domestic battery market. CATL, the world’s largest battery manufacturer, is pushing the limits of battery technologies, with claims that it can add 300 miles of charge in just 5 minutes (I have some doubts about battery degradation, but I’d obviously love this to be true). The list goes on.

China mainly dominates these markets because it has produced a long-term industrial strategy for these technologies and has honed an optimised, modern supply chain as a result.

The notion that China’s manufacturing output is purely the result of some centralised, governmental program is misguided; it has developed an incredibly competitive market with companies fighting for any edge to cut prices and beat competitors. The solar and battery industries are pretty brutal to be in, with slim margins.

Since China also refines a lot of the minerals and smaller components, its supply chains can become incredibly integrated, which also makes them more optimised.

The second big chunk is labour costs. Now, it’s undeniable that wages in the US are higher than they are in China. But this is not necessarily because Chinese salaries are abysmally low. Yes, they are low by American or European standards, but wages for factory roles are often higher than they are in the US’s southern neighbour, Mexico.

The biggest factor in labour costs is automation. The US uses six times as many workers per GWh (I initially found these numbers pretty shocking and hard to believe), so it’s not surprising that labour costs much more. China has invested heavily in automation, meaning many processes run with very little human input.

This is something else to keep in mind when considering the case for “bringing manufacturing jobs home.” There’s certainly scope for this, but it is at odds with the fact that low costs often rely on automation, not human labour. Especially with the growth of artificial intelligence, some manufacturing jobs could be increasingly vulnerable.

3 notes

·

View notes

Text

How to Choose the Best CRM Software for Your Business

Choosing the right CRM software for your business is a big decision — and the right one can make a world of difference. Whether you’re running a small startup or managing a growing company, having an effective CRM (Customer Relationship Management) system helps you keep track of customers, boost sales, and improve overall productivity. Let’s walk through how you can choose the best CRM for your business without getting overwhelmed.

Why Your Business Needs a CRM

A CRM isn’t just a tool — it’s your business’s central hub for managing relationships. If you’re still relying on spreadsheets or scattered notes, you’re probably losing time (and leads). A good CRM helps you:

Keep customer data organized in one place

Track leads, sales, and follow-ups

Automate routine tasks

Get insights into sales performance

Improve customer service

The goal is simple: work smarter, not harder. And with an affordable CRM that fits your needs, you’ll see faster growth and smoother processes.

Define Your Business Goals

Before diving into features, figure out what you actually need. Ask yourself:

Are you trying to increase sales or improve customer service?

Do you need better lead tracking or marketing automation?

How big is your team, and how tech-savvy are they?

What’s your budget?

Knowing your goals upfront keeps you from wasting time on CRMs that might be packed with unnecessary features — or worse, missing key ones.

Must-Have Features to Look For

When comparing CRM options, focus on features that truly matter for your business. Here are some essentials:

Contact Management – Store customer details, interactions, and notes all in one place.

Lead Tracking – Follow leads through the sales funnel and never miss a follow-up.

Sales Pipeline Management – Visualize where your deals stand and what needs attention.

Automation – Save time by automating emails, reminders, and data entry.

Customization – Adjust fields, workflows, and dashboards to match your process.

Third-Party Integrations – Ensure your CRM connects with other software you rely on, like email marketing tools or accounting systems.

Reports & Analytics – Gain insights into sales, performance, and customer behavior.

User-Friendly Interface – If your team finds it clunky or confusing, they won’t use it.

Budget Matters — But Value Matters More

A CRM doesn’t have to cost a fortune. Plenty of affordable CRM options offer robust features without the hefty price tag. The key is balancing cost with value. Don’t just chase the cheapest option — pick a CRM that supports your business growth.

Take LeadHeed, for example. It’s an affordable CRM designed to give businesses the tools they need — like lead management, sales tracking, and automation — without stretching your budget. It’s a smart pick if you want to grow efficiently without overpaying for features you won’t use.

Test Before You Commit

Most CRMs offer a free trial — and you should absolutely use it. A CRM might look great on paper, but it’s a different story when you’re actually using it. During your trial period, focus on:

How easy it is to set up and start using

Whether it integrates with your existing tools

How fast you can access and update customer information

If your team finds it helpful (or frustrating)

A trial gives you a real feel for whether the CRM is a good fit — before you commit to a paid plan.

Think About Long-Term Growth

Your business might be small now, but what about next year? Choose a CRM that grows with you. Look for flexible pricing plans, scalable features, and the ability to add more users or advanced functions down the line.

It’s better to pick a CRM that can expand with your business than to go through the hassle of switching systems later.

Check Customer Support

Even the best software can hit a snag — and when that happens, you’ll want reliable support. Look for a CRM that offers responsive customer service, whether that’s live chat, email, or phone. A system is only as good as the help you get when you need it.

Read Reviews and Compare

Don’t just rely on the CRM’s website. Read reviews from other businesses — especially ones similar to yours. Sites like G2, Capterra, and Trustpilot offer honest insights into what works (and what doesn’t). Comparing multiple CRMs ensures you make a well-rounded decision.

The Bottom Line

Choosing the best CRM software for your business doesn’t have to be complicated. By understanding your goals, focusing on essential features, and keeping scalability and budget in mind, you’ll find a CRM that fits like a glove.

If you’re looking for an affordable CRM Software that checks all the right boxes — without cutting corners — LeadHeed is worth exploring. It’s built to help businesses like yours manage leads, automate tasks, and gain valuable insights while staying within budget.

The right CRM can transform how you run your business. Take the time to find the one that supports your growth, keeps your team organized, and helps you deliver an even better experience to your customers.

3 notes

·

View notes

Text

How Beginners Can Use Investing Apps to Start Building Wealth?

Stock trading has been on the rise for quite some time now, especially among youngsters. The youth are on the constant lookout for newer investing apps which make their job easy. E-commerce apps that provide investing services have also surged to impeccable heights & made wealth for a significant number of individuals. There’s no fixed formula for investing in the stock market. A well-structured portfolio & strategic investments can take you to quite wealthy distances.

For C-suite executives, startup entrepreneurs, and managers, understanding how investing apps empower users is essential—not only for personal financial growth but also to stay informed about technological advancements in the financial sector. This article explores how beginners can leverage investing apps to start building wealth effectively and strategically.

The Game-Changing Impact of Investment Platforms

The rise of investing apps has eliminated traditional barriers such as high fees, complicated processes, and the necessity for financial advisors. These apps have democratized investing through features such as:

Low or No Commission Fees – Many platforms offer commission-free trades, making investing more affordable.

Fractional Shares – Users can invest in small portions of high-priced stocks, allowing broader access to valuable assets.

Automated Portfolio Management – Robo-advisors create customized portfolios based on individual risk tolerance and financial goals.

Educational Resources – Built-in learning materials help beginners understand market trends and investment strategies.

User-Friendly Interfaces – Simple navigation, real-time analytics, and personalized recommendations make investing more intuitive.

By incorporating these features, investment platforms make financial markets more inclusive, giving users the ability to take charge of their financial futures.

Steps for Beginners to Start Investing

1. Define Your Investment Goals

Before selecting an investing app, users should determine their financial objectives. Are they investing for retirement, wealth accumulation, or short-term financial gains? Identifying goals helps in choosing appropriate investment strategies and risk levels.

2. Choose the Right Investing App

Different investment platforms cater to various investor needs:

Stock Trading Apps (e.g., Robinhood, Webull) – Best for hands-on trading.

Robo-Advisors (e.g., Betterment, Wealthfront) – Ideal for automated, long-term investing.

Micro-Investing Apps (e.g., Acorns, Stash) – Suitable for those starting with small amounts.

Social Investing Apps (e.g., eToro, Public) – Allow users to follow and replicate expert traders.

Cryptocurrency Apps (e.g., Coinbase, Binance) – For those looking to diversify into digital assets.

3. Start Small and Diversify

Beginners should avoid placing all their funds into a single stock or asset class. A diversified portfolio—including stocks, ETFs, bonds, and real estate—helps manage risk. Many investing apps provide guidance on asset allocation to optimize investment strategies.

4. Utilize Automated Investment Tools

Features such as recurring deposits and robo-advisors enable users to invest consistently without the need for active monitoring. Automation removes emotional biases and encourages disciplined investment habits.

5. Continuously Learn and Adapt

While investing apps simplify the investment process, continuous learning is crucial. Staying updated on financial news, market trends, and portfolio performance enhances decision-making and long-term success.

Common Mistakes to Avoid When Using Mobile Trading Apps

1. Emotional Decision-Making

Market fluctuations can trigger impulsive buying or selling. It is vital to maintain a long-term perspective rather than reacting to short-term volatility.

2. Overtrading

Many beginners engage in excessive trading due to the accessibility of investing apps. Frequent transactions can lead to unnecessary fees and market timing errors, ultimately reducing profits.

3. Ignoring Fees and Hidden Costs

Although many platforms offer commission-free trading, other charges such as fund expense ratios and premium account fees can accumulate. Users should evaluate costs before committing to an app.

4. Failing to Rebalance Portfolios

Market changes can impact asset allocation over time. Regularly reviewing and adjusting investment portfolios ensures alignment with financial goals and risk tolerance.

5. Neglecting Tax Implications

Investing comes with tax obligations, including capital gains taxes. Some trading applications provide tax-loss harvesting features, which can help users optimize their tax liabilities and maximize returns.

The Future of Investing Apps in Wealth-Building

With advancements in AI, blockchain technology, and machine learning, the next generation of investing apps will offer even more personalized, intelligent, and secure solutions. Features such as AI-driven financial advisors, real-time risk assessment, and decentralized finance (DeFi) integration are set to redefine digital investing.

Furthermore, stock market apps are expanding to include more asset classes, such as real estate crowdfunding, private equity, and alternative investments, broadening opportunities for investors.

For business leaders and entrepreneurs, staying ahead of these trends is crucial. Whether using investing apps for personal wealth-building or incorporating fintech innovations into business strategies, digital investment tools present vast opportunities for financial growth.

Conclusion

The accessibility and convenience of trading applications have transformed the investment landscape, allowing beginners to build wealth with minimal capital and financial expertise. By defining clear financial goals, selecting the right platform, diversifying assets, and committing to continuous learning, users can effectively manage their financial future.

As investing apps continue to innovate, they will play an increasingly crucial role in shaping financial markets and fostering inclusive investment opportunities. The democratization of finance through trading portfolio ensures that wealth-building is no longer limited to a select few. With the right strategies and tools, anyone can participate in the financial markets and work toward a prosperous future.

Uncover the latest trends and insights with our articles on Visionary Vogues

3 notes

·

View notes

Text

Austin’s 3D printed neighborhood could signal a shift in homebuilding (video)

- By Nuadox Crew -

On the outskirts of Austin, Texas, a groundbreaking housing development is taking shape—literally—layer by layer. The project, a collaboration between homebuilding giant Lennar and construction tech firm Icon, marks the largest community of 3D printed homes in the world.

youtube

Video: "Inside The World’s Largest 3D Printed Neighborhood" by CNBC, YouTube.

With 100 houses built over two years, the initiative serves as a pilot for faster, more cost-effective construction methods.

The development comes at a critical time for the U.S. housing market, which faces a shortage of approximately four million homes. Rising labor costs and soaring material prices have made homeownership increasingly out of reach for many Americans. Against this backdrop, 3D printing is being tested as a viable way to increase supply and stabilize costs.

For Holly, one of the community’s first residents, the benefits are already evident. She and her family were drawn to the home’s sleek design and promise of energy efficiency. A year later, she reports consistently low electric bills—just $26 in January—and appreciates the home’s resistance to wind, fire, and mold. At just under $400,000, the price point is competitive with larger, traditionally built homes in the area.

At the heart of the construction process is Icon’s robotic technology, which can produce a house in roughly two weeks. The system relies on digital blueprints uploaded to a proprietary platform called Build OS, which automates structural reinforcement, wiring, and plumbing. With only three workers needed to operate the machinery, the process is a significant step toward labor reduction—a key factor in scaling affordable housing.

The project encountered early setbacks. Initial builds took longer and cost more than expected. But through trial and error, the team refined their methods—adjusting wall thickness and adopting more open floor plans to streamline production.

Lennar and Icon are already preparing their next phase: a new community featuring twice as many homes, lower price points, and enhanced 3D printing capabilities that could eventually fabricate complete building envelopes, including roofs and foundations. The technology also holds promise for disaster-prone regions, where fire-resistant materials and durable design could be life-saving.

Although 3D printed homes have yet to match the profitability of conventional construction, the partnership signals a broader transformation in an industry long resistant to change. If successful, this model could pave the way for more sustainable, resilient, and accessible housing across the country.

Header image credit: Icon

Related Content

What is Energy House 2.0?

Other Recent News

Ultra-thin wearable haptics: A flexible patch brings tactile sensations to virtual experiences.

Innovative sponge-like device harvests moisture directly from the air.

2 notes

·

View notes

Text

OVERESTIMATION OR UNDERESTIMATION OF PROPERTY VALUE

Valuation of property is somewhat an elaborate process, as one would note, wherein every decision carries a lot of weight. Getting the value of a property right can make all the difference in financial outcomes-be it buying, selling, or leveraging for loans. Valuations carry a lot of importance, and with so much at stake, it becomes important to learn those factors that contribute to overestimation or underestimation of property value.

THE DELICATE BALANCE: WHY VALUATION MATTERS

A correct property valuation creates the proper avenue for fair transactions. Overvaluation will create financial burdens, while undervaluation could result in the loss of potential income. Knowing how to hit that sweet spot in valuation not only avoids costly mistakes but also enriches investment opportunities.

THE DANGERS OF INCORRECT ASSESSMENT: LEGAL AND FINANCIAL IMPLICATIONS

Incorrect property assessment may have serious consequences, both legally and financially, and includes:

Financial Impairment

Overpayment for a building is a waste of resources.

Legal Consequences

Fraudulent representation of property value may result in claims and subsequent lawsuits.

Market Standing

An inappropriate valuation might amount to loss of credibility and thus have an effect on all future transactions.

FACTORS THAT CAUSES OVERESTIMATION OF PROPERTY VALUE

Market Trends and Investors' Sentiment: A Case of Bubble Effect?

Speculation on existing trends can also overstate the price of a property. In a hot market, with investors hyping it up, prices will continue to soar and create a bubble that may not actually be real in the market. This may result in bad decisions regarding investments that could have otherwise been rectified after the bubble has burst.

Emotional Attachments and Personal Biases: The Owner's Perspective

Property owners often view their home from a value perception and cannot always think clearly. The sentimental attitude may make homeowners believe their property is worth more than what the market truly reflects. This again is where the need for objective analysis comes into play.

Lack of Comparative Market Analysis: Inadequate Information

Comparitive Market Analysis, or CMA, is an indispensable part of the valuation process. If this is not performed, there is a chance of overvaluation based on incomplete or selective information. Any realistic valuation requires similarity in the market.

FACTORS CAUSING PROPERTY UNDER-VALUATION

Disregarding Recent Renovations and Improvements

Renovations can work wonders in adding value to property, but owners hardly consider that. Not considering upgrades means gaining less than what is expected in a financial perspective. It is very important to keep an eye on what has been improved to do a property's valuation in a fair way.

Lack of Considering Advantages of Location: Neighborhood Dynamics

Location can dramatically affect the value of a property. Factors to consider include proximity to schools, parks, and public transport that can increase value. Benefits that are often overlooked could lead to undervaluation and consequently detract from potential selling.

Lack of Research into Comparable Properties: Data Gaps

Not researching similar properties can create data gaps that lead to understatement. Not considering other properties around it, which are recently sold, makes it difficult to determine the exact market value.

COMMON MISTAKES IN PROPERTY VALUATION

Relying on Online Estimators: Limitations of Automated Systems

Online estimators can at best give a ballpark figure. Very often, critical subtleties are missed by these online calculators. Hence, relying only on such tools invites major mistakes and masks the real worth of properties.

Neglecting Professional Appraisal: How It Pays to Seek Expert Opinion

Another mistake commonly made is neglecting the value of a professional appraisal. Experienced appraisers possess certain insights that no online system can offer, and they ensure far more accurate valuations.

Judging Erroneous Market Information: Statistical Misconceptions

Statistics sometimes portray an incorrect picture. Biased data or incomplete information may infer incorrect inferences about the property's value. A balanced approach is called for to bring clarity to such data.

PRACTICAL APPLICATION OF CORRECT PROPERTY VALUATION

Data Accumulation

Accumulate necessary data regarding neighborhood trends and property specific data.

Properties similar to each other and recent sales would be compared.

Keep in mind things like renovations or changes in the market to give a far more realistic estimate.

Engaging Qualified Professionals: Estate Surveyors, and Valuers

Bringing professionals into this will serve to heighten the accuracy. They have experience and knowledge which becomes quite necessary for any valid valuation. This experience allows them to handle the intricacies of the market.

Cross-Referencing Multiple Methods for Better Valuation Accuracy

Using multiple valuation approaches triangulates property value with a wider scope for reliability.

Mitigating Risks of Overvaluation and Undervaluation

Due Diligence:

Thorough Research and Data Collection, Thorough research has to be done; indeed, it is the collection of different data that may protect against certain valuation mishaps.

Seeking Multiple Opinions

Gather diverse opinions about the value of the property. This would help to avoid the confirmation bias that is usually associated with opinions of the worth of something.

CONCLUSION

Property value is essential for making informed investment choices. Misjudging this value can result in major financial losses. The analysis underscores the necessity of precise property evaluations to attain optimal results. For clients looking for straightforward advice, contacting Lansar Aghaji & co. can offer the professional insights needed to manage property assessments successfully. Move forward in your property endeavors and engage wi

2 notes

·

View notes

Text

ChannelBuilderAI Review: The Ultimate Automated Video Creation Solution

Introduction: Revolutionizing Content Creation

In today's fast-paced digital landscape, content creators face immense pressure to produce high-quality videos consistently. ChannelBuilderAI emerges as a game-changing solution, promising to streamline the entire video production process—from scripting to publishing. After extensive testing across multiple niches, I’m convinced this platform represents a significant leap forward in AI-powered content creation.

Core Features and Capabilities

ChannelBuilderAI stands out with its comprehensive feature set, addressing every stage of video production:

Advanced Script Generation: Crafts engaging, structured narratives tailored to your niche (e.g., horror, business, or education).

Human-Like Voiceovers: 78 voice options across 12 languages with emotional inflection (excitement, suspense, authority).